closed end credit account

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. A written agreement should be made between lender and borrower.

Choosing Closed End Credit Funds Over Equity Funds Seeking Alpha

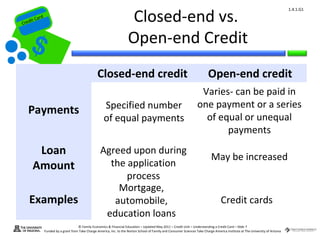

Closed-end credit is an extension of credit that must be repaid in full by a specified date.

. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account. You can find smartphone financing at retail stores that sell cellphones or through cellphone. A closed account is any account that has been deactivated or otherwise terminated either by the customer custodian or counterparty.

Hence the creditor would either have to. At this stage no further credits. By contrast open-end credit is revolving credit like a credit card that enables you to.

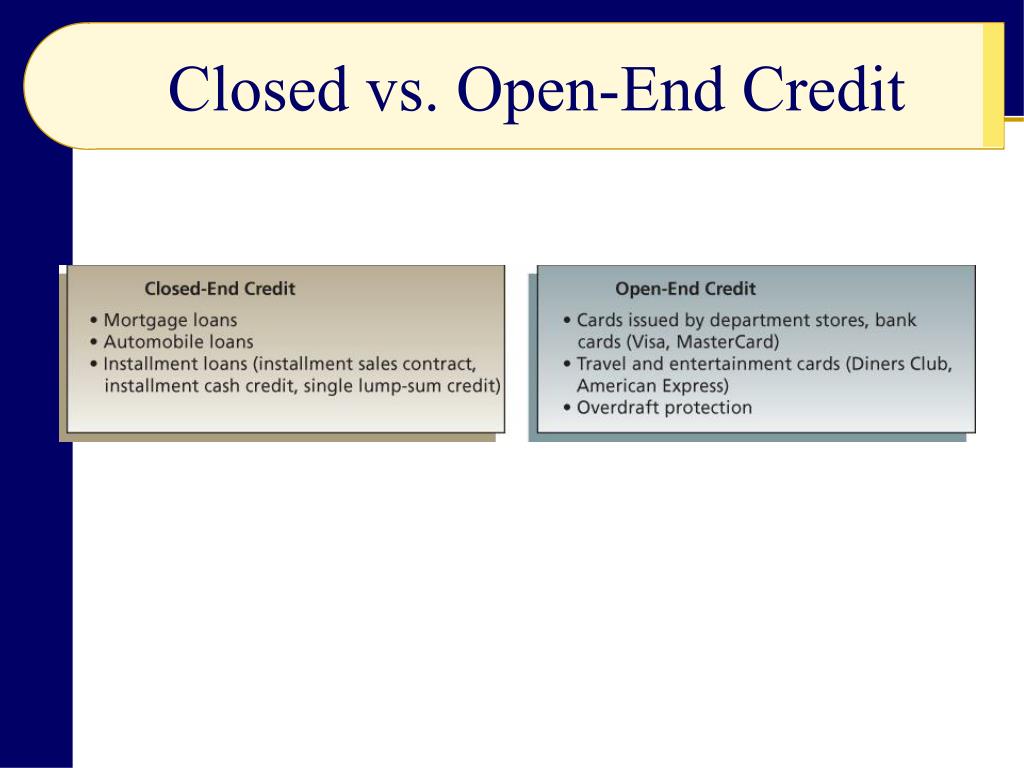

Typically a closed-ended contract is one where there is a set number of payments for a set period of time and you do not get to reuse any amount of the loan youve. Closed-end and open-end credit offer different ways to borrow money and the right choice comes down to what the funds are for how predictable your expenses are and. Common Examples of Closed-End Credit Smartphone Financing.

This is an installment loan borrowers usually take out for a specific purpose. In a closed-end credit the amount borrowed is. Lenders extend a specific amount of money that must be repaid including.

Closed-end and open-end credit differ depending on how funds are disbursed and how payments are made to the account. A creditor has no existing business relationship with consumers whose closed end credit accounts have been paid off ie former borrowers. Examples of closed-end credit include personal loans auto loans mortgages.

Except for home equity plans subject to 102640 in which the agreement provides for a repayment phase if an open-end credit account is. Converting open-end to closed-end credit. The most important things to know about closed end credit You must make regular planned payments that include both the principal and the interest rate until you have.

Closed end credit is different because it doesnt allow you to continue using the same credit over and over. On closed-end credit youll have a fixed payment that allows you to pay off your balance with a set amount each month which may make budgeting easier. The borrower can reuse.

With closed end credit when you originally apply for a loan with. Closed end credit is offered by financial institutions often referred to it as an installment loan or a secured loan. Closed-end credit allows you to borrow a specific amount of money for a finite term.

Mlo Mentor Section 35 Loans Firsttuesday Journal

Plz Help What Is One Type Of Closed End Credit A A Credit Card B A Retail Credit Card C An Brainly Com

How Revolving Credit Works Howstuffworks

Ppt Credit In America Powerpoint Presentation Free Download Id 2679818

Closed End Credit Definition Fiscal Tiger

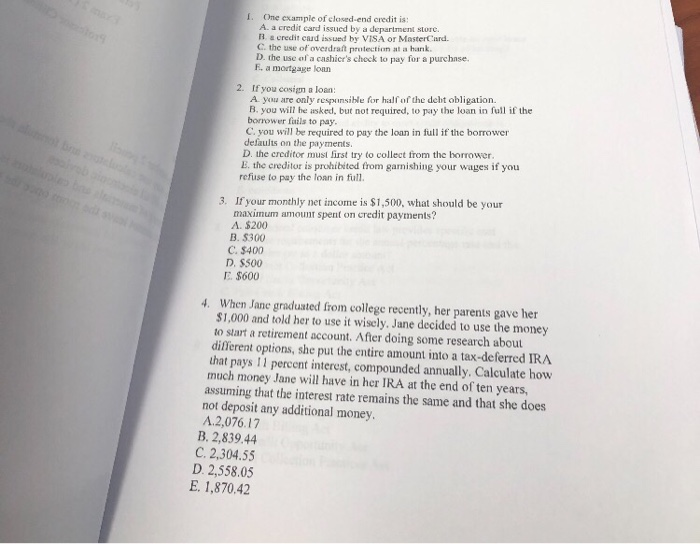

Solved 1 One Example Of Closed End Credit Is A A Credit Chegg Com

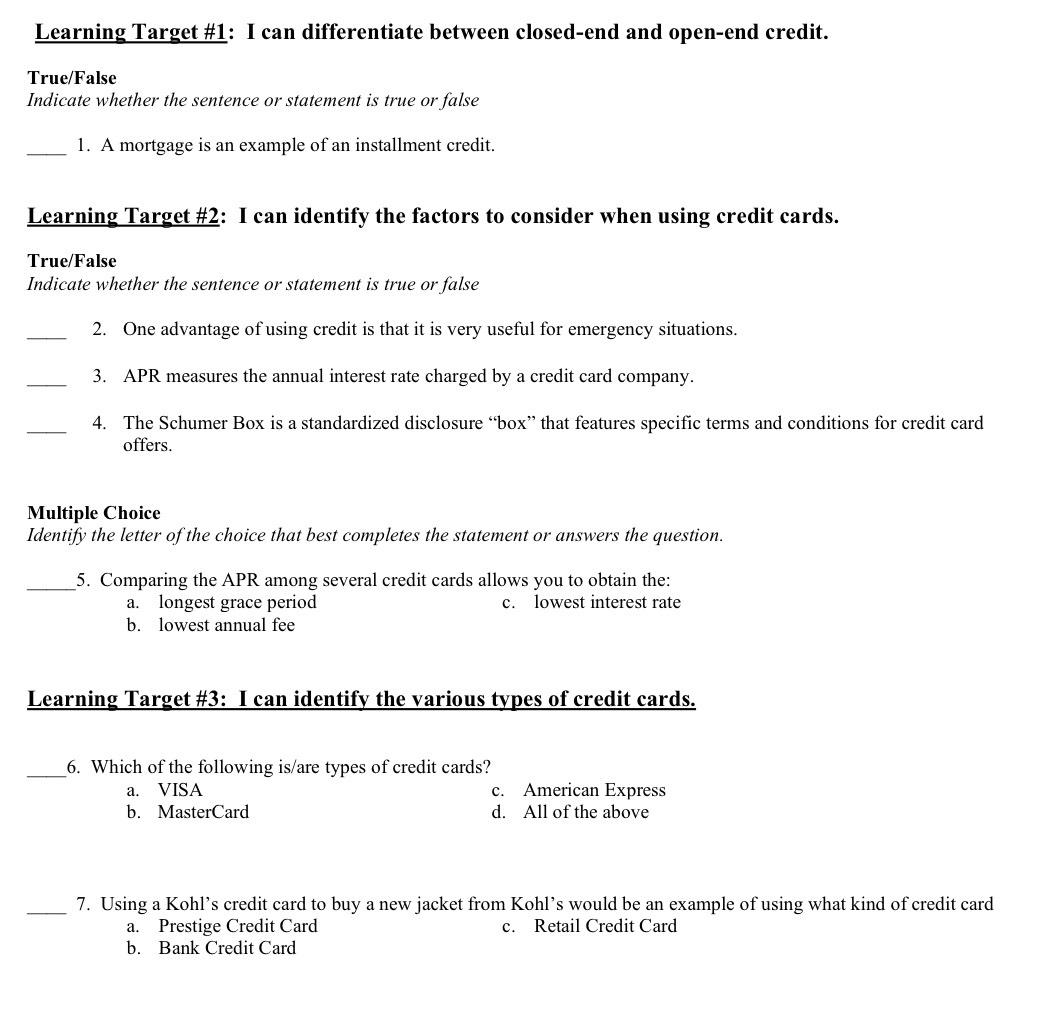

Solved Learning Target 1 I Can Differentiate Between Chegg Com

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Money Patrol Line Of Credit Facebook By Money Patrol What Is Line Of Credit People Who Don T Vote Have No Line Of Credit With People Who Are Elected

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Goodheartwillcox Co Inc 1 9 Credit Goodheartwillcox Co

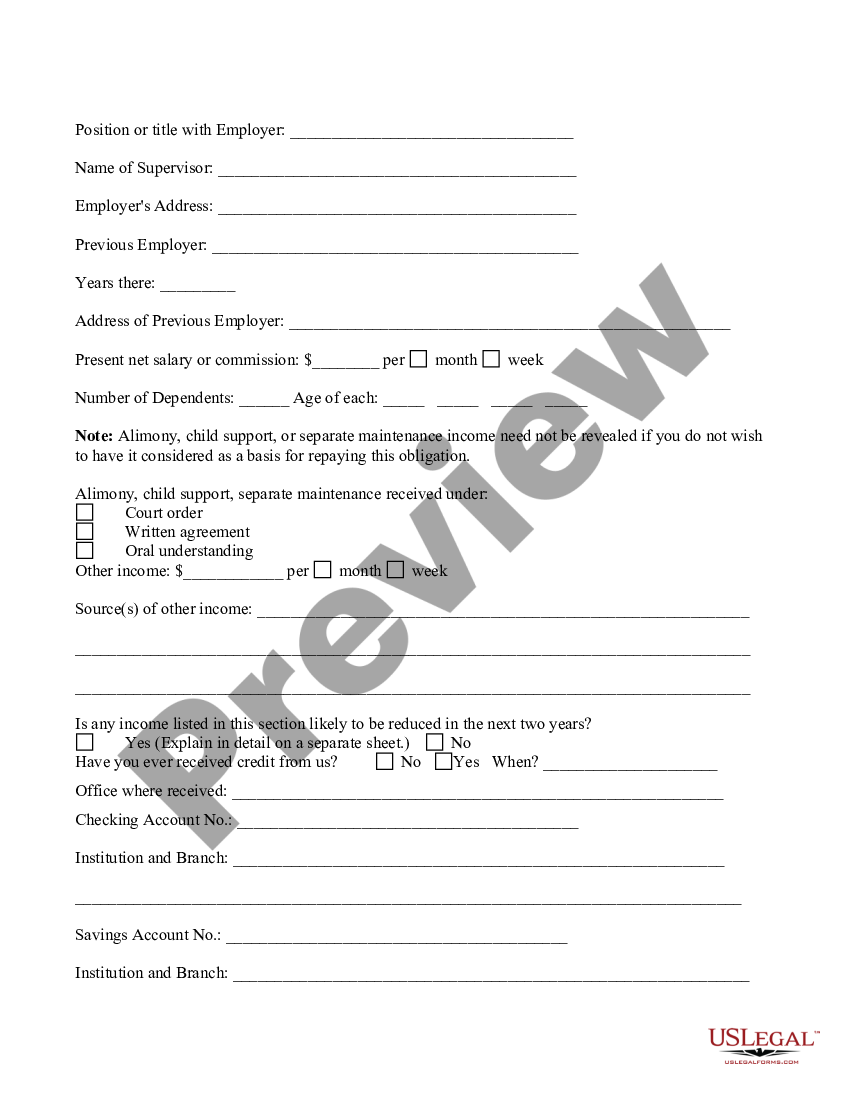

Application For Open End Unsecured Credit Signature Loan Us Legal Forms

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Ppt Chapter 6 Credit Use And Credit Cards Powerpoint Presentation Free Download Id 5727535

Closed End Credit Versus Open End Credit 2020 Youtube