nh property tax rates by town 2020

The New Hampshire Department of Revenue Administration has approved the Citys 2020 tax rate for Fiscal Year 2021 of 1470 per 1000 of valuation. If you would like an estimate of the property tax owed please enter your property assessment in the field below.

10 States With No Property Tax In 2020 Property Tax Property Investment Property

We are working hard at giving you the real time quotes for every county and lender.

. What are you looking for. New Hampshires median income is 73159 per year so the median. The sum of monies collected by a municipality for the Residents Tax pursuant to RSA 721.

2020 NH Property Tax Rates. Swains Lake Coffer Dam - Public Notice March 28 2022. 236 rows town total 2020 tax rate change from 2019.

2 2017 tax rate reflects the new assessed valuation determined through a Citywide valuation. Properties Located in Waterville Estates Village District. The New Hampshire Department of Revenue Administration has approved the Citys 2020 tax rate for Fiscal Year 2021 of 1470 per 1000 of valuation.

Website Disclaimer Government Websites by. YearRateAssessed Ratio2021 2020 2019 2018 2017 20162131 2848 2696 2723 2601 2510 947. Although the Department makes every effort to ensure the accuracy of data and information.

2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate - LOCAL1291 School Tax Rate - STATE170 County Tax Rate080TOTAL1876Median Ratio 1002 2019Town Tax Rate449School Tax Rate - LOCAL1479Scho. Revaluation of Property and the Tax Rate Setting Process. Fremont tax rate historical data.

The total of each of the above listed columns for all ten counties in the state. Box 660 333 Calef Highway Rte. This tax rate does not include any village district or precinct tax rates.

Ad Get a Vast Amount of Property Information Simply by Entering an Address. 2020 Tax Rate Information. City Manager John Bohenko said the 2019 tax rate dropped by 98 or 62 from the prior year tax rate of 1584 and 135 or 83 from the.

Assessment rate for real property is 100 percent. City Sets Property Tax Rate at 1470. The county tax rate listed is the average county tax rate and is.

New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. Property Tax Bill Payment Options. 1 Rates are based on assessed value of property.

We Provide Homeowner Data Including Property Tax Liens Deeds More. Gail Stout 603 673-6041 ext. View current and past tax rates.

That is a decrease of 374 or 17. Concord City Hall 41 Green Street Concord NH 03301 Phone. The ratio for 2021 is 961 the 2022 ratio has not been established yet by the Department of Revenue.

All banks mortgage rates are different. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Dorchester 111721 45178890 989433 Dover 120121 4472310130 95862031 Dix Grant U 120221 1072502 0. Regular Part of Town.

088 001 total rate. 2020 nh property tax rates. The 2021 tax rate is 1768 per 100000 of assessed valuation.

See also the City of Manchester Finance Department for a look at historical property tax rates. Tax amount varies by county. City of Dover New Hampshire.

The nh department of revenue administration has finalized the towns 2020 tax rate and the rate for 2020 is 1876 per thousand dollars of assessed value. See Personal Exemptions Veterans Tax Credits and Other Exemptions. 1 Rates are based on assessed value of property.

The exact property tax levied depends on the county in new hampshire the property is located in. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. 2020 Swains Lake Drawdown - 9282020 Update.

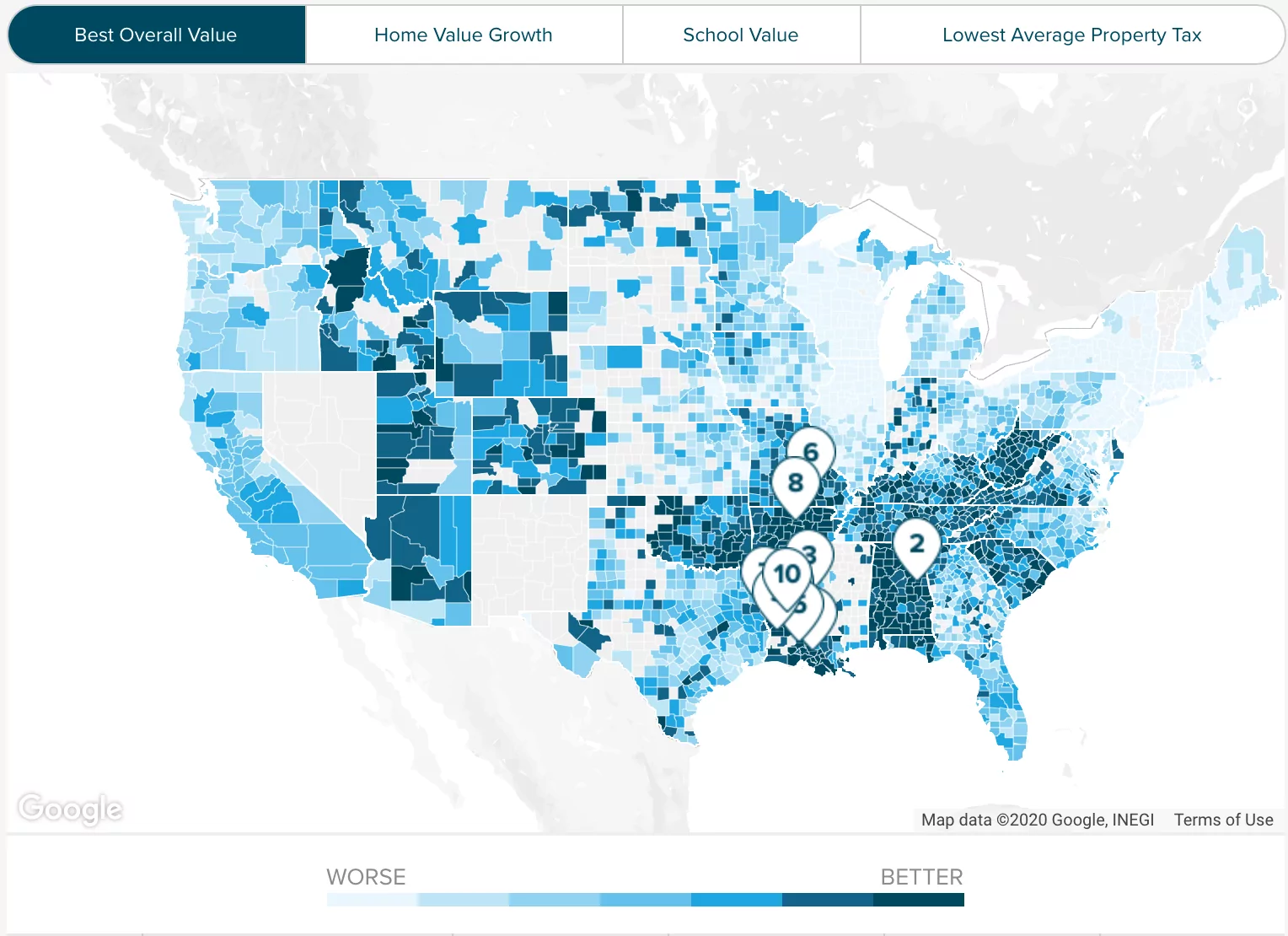

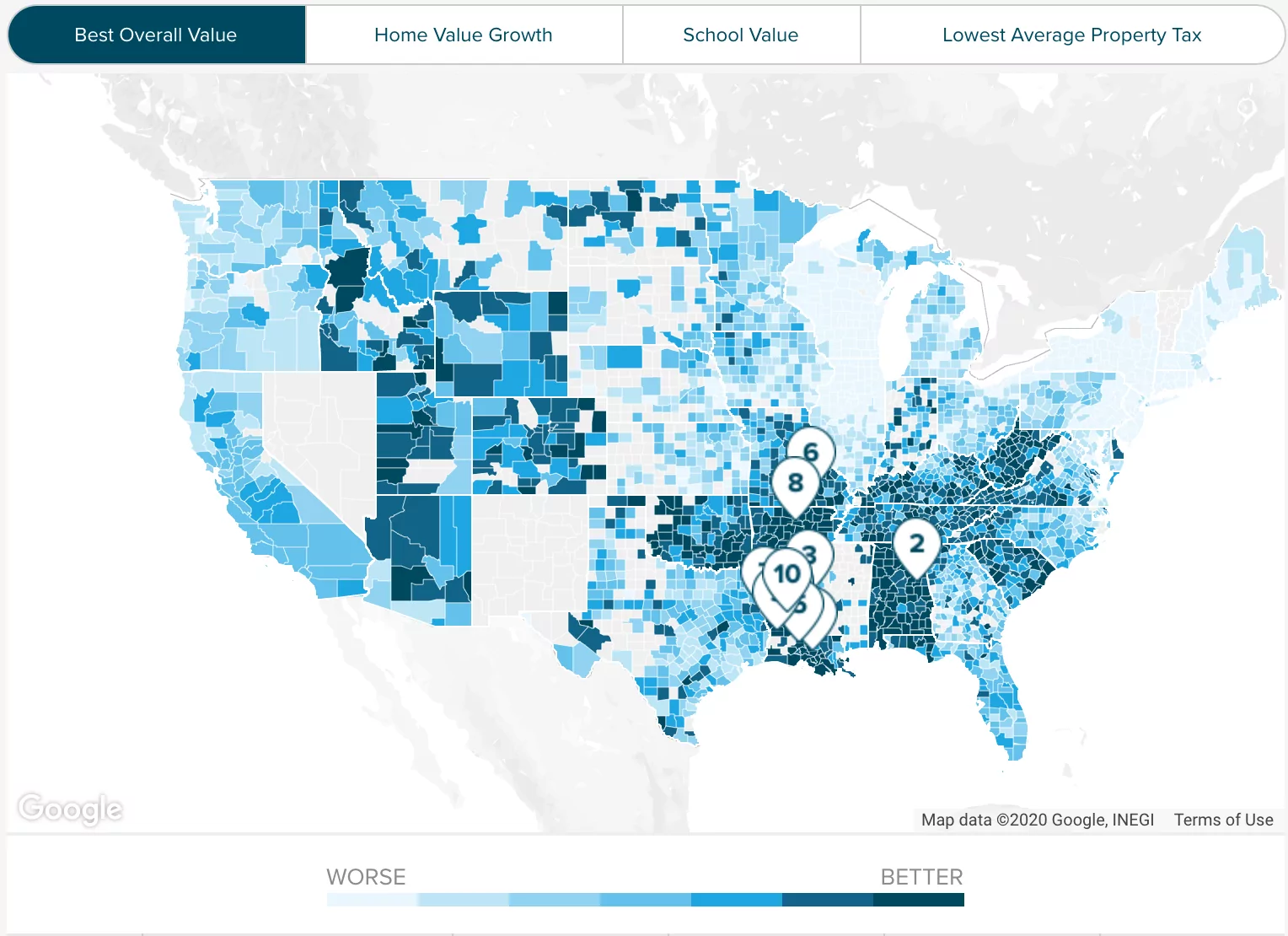

90 rows Map of New Hampshire 2021 Property Tax Rates - See Highest and Lowest NH Property. Hudsons share of the county tax burden for 2005 was approx. PORTSMOUTH The New Hampshire Department of Revenue Administration has approved the Citys 2019 tax rate for Fiscal Year 2020 of 1486 per 1000 of valuation.

The following are the reports published for the 2020 Tax Year. That is an increase of 066 or 35 compared to 2020. Tap or click any marker on the map below for more information From Concord to Keene to Rye to Jackson to Nashua.

Town of Amherst 2 Main Street Amherst NH 03031 603-673-6041. State Education Property Tax Warrant. New Hampshire Property Tax Rates.

You Can See Data Regarding Taxes Mortgages Liens Much More. Properties Located in Campton Village Precinct. City Property Tax Rate Set at 1486.

The following table sets forth the Citys tax rate by City School and County for each of the last five fiscal years. The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. Valuation Municipal County State Ed.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Campton 112320 439337540 11703154 Canaan 102820 347549588 11898029 Cambridge U 120120 9219051. 236 rows Town Total 2020 Tax Rate Change from 2019. All documents have been saved in Portable Document Format.

Online Property Tax Worksheet. Ad Uncover Available Property Tax Data By Searching Any Address. Valuation Municipal County State Ed.

The breakdown below represents what contributes to the tax rate. 15 15 to 25 25 to 30 30. Most of the duties of the tax collector are specified by New Hampshire state law RSAs under Title V.

15 15 to 25 25 to 30 30. Ashley Saari can be reached at 924-7172 ext. Exemption and Tax Credit reports have been removed and placed on a separate Municipal and Property Divsion page.

The 2020 tax rate is 1470 per thousand dollars of valuation. City Manager Karen Conard noted the 2020 tax rate dropped by 16 cents or 11 from the prior years tax rate of 1486.

Realtors Expect These Neighborhoods To Sell Big In 2020 The Neighbourhood Real Estate Lake Ontario

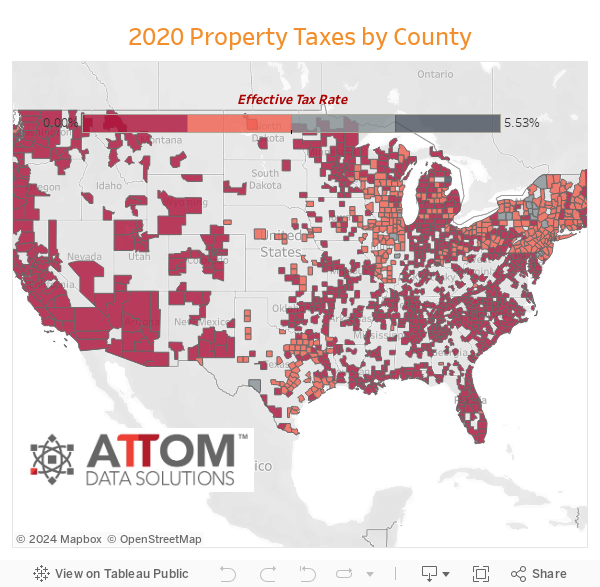

Property Tax Comparison By State For Cross State Businesses

Countries With No Property Tax Tax Free Countries

Newmarket Property Tax 2021 Calculator Rates Wowa Ca

Washington Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Orange County Ca Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Property Taxes How Much Are They In Different States Across The Us

Deducting Property Taxes H R Block

Property Tax Information Town Of Exeter New Hampshire Official Website

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Most Expensive U S Zip Codes In 2021 10 Areas Surpass 4 Million Median Sale Price Coding Zip Code Home Buying

Florida Property Tax H R Block

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)